Custom Malaysia has updated the DGs Decision 42014 Item 6 and the amendments were effective from 28 October 2015. The Service tax is also a single-stage tax with a rate of 6.

The Connection Issue 21 Individual Supply Of Commercial Property Land Cheng Co Group

B Made by a taxable person.

. Any individual that supplies commercial property or commercial land worth more than 2 million ringgit at market price after 28 October 2015 shall liable to register for GST. GST is charged on all taxable supplies of goods and services in Malaysia except those specifically exempted. Normally standard rated supplies GST labelled with an S.

Whether an individual has to charge GST when making a supply of his commercial property. If sold after 6 years. GST is also charged on importation of goods and services into Malaysia.

As one of the most sophisticated sectors undoubtedly property and construction industry faced greater challenges in complying with GST rules. This article looks at some of the significant impacts GST has brought. I am an individual selling a commercial property am I subject to GST.

This DGs decision clarifies the GST treatments for Individual supplies commercial properties ie. Sales of commercial real estate such as office towers retail buildings and land zoned for commercial use are subject to a 6 percent GST if the seller is an individual is engaged in the business. Section 9 of GST Act stipulates that tax shall be charged on any supply of goods or service made in Malaysia where it is a taxable supply made by a taxable person in the course or furtherance of any business carried on by him.

The existing standard rate for GST effective from 1 April 2015 is 6. Individual supply commercial property i on any taxable supply of goods or services made in Malaysia section 9 GSTA. Whether the supply made is a taxable supply.

If sold before 5 years. In the service tax no input exemption mechanism is. The current regulations might confused a lot of people who originally thought they were exempt from this levy according to Deloitte Malaysia an.

If sold within 3 years. 28042016 sales of commercial real estate such as office towers retail buildings and land zoned for commercial use are subject to a 6 percent gst if the seller is an. Of late last year the Malaysian Royal Customs Department has did an update on the GST registration for individual supply for commercial property.

Item 2Supply of commercial property build sell by the developer to the purchaser under an agreement for a period that begins before the effective date and ends on or after the Item 3Eligibility for deemed Input Tax under Regulation 47 of. If sold before 4 years. Goods and Services Tax GST is a multi-stage tax on domestic consumption.

The current regulations might confused a lot of people who originally thought they were exempt from this levy according to Deloitte Malaysia an. Service Tax is charged on a specific service provided by a taxable person in Malaysia carrying out a business. Payment of tax is made in stages by the intermediaries in the production and.

C In the course of furtherance of business. A Taxable supply means- a supply of goods and services which are. Under the law when an individual would be subject to GST if.

By 9 July 2015 we usher 100 days on from the start of GST one of the major pieces of tax reform the country has seen. Our lawyers in Malaysia describe the provisions of the Public Ruling and can help you determine how the tax applies in your case for. Question then arises as to whether an individual who is not a GST registered person is required to pay GST when making a supply of his commercial property.

RPGT increases progressively as follows for commercial property. He owns more than 3 commercial properties. The Goods and Services Tax GST is an abolished value-added tax in Malaysia.

A Taxable supply of goods services. Tax shall be charged basing on 4 important elements. For the consumers they can identify the standard rated supplies by looking at the receipt when making the purchase.

GST shall be charged by a taxable person in the course or furtherance of business on any taxable supply of goods or services made in Malaysia section 9 GSTA. Any individual that supplies commercial property or commercial land worth more than 2 million ringgit at market price after 28 October 2015 shall liable to register for GST. Panel Decision 4 Author.

He is selling a commercial property for more than 2 million. The Decision 4 2014 made by the Director General of the Royal Malaysian Customs as amended with effect from 28 October 2015 provides more clarify on this point. This tax is not required for imported or exported services.

This dgs decision clarifies the gst treatments for individual supplies commercial properties ie. GST is levied on most transactions in the production process but is refunded with exception of Blocked Input Tax to all parties in the chain of production other than the final consumer. AND the total selling price exceeds RM50000000.

A supply becomes taxable where the annual sales turnover exceeds RM500. Unlike residential properties the sale of commercial properties is a clear cut case which falls under the Standard-rated supply and is taxable under the GST. Late Registration Period Days Cumulative RM 1 30.

Whether an individual has to charge GST when making a supply of his commercial property. 12018 issued by the Malaysian Tax Agency sets forth the applicability of the goods and services tax on the sale of buildings located on commercial land used for both commercial and residential purposes. Keep in mind that tax rates change frequently and you should check the latest government information for up-to-date data.

The examples of standard rated supplies are local supply of goods or services supply of land and building for commercial and construction of all types of building. GSTA section 2 of the current month and the next eleven months exceeds RM500000 GST shall be charged by a taxable person in the. Whether an individual has to charge GST when making a supply of his commercial property.

Standard rated supply such as sale lease of commercial properties. Any late registration will be subject to penalty based on number of days late which capped at RM20000. Public Ruling No.

My article dated October 9 2015 on GST for individual supply was written and immediately after that on the 28th of October the new decision take effect. He is selling a commercial land of more than 2 acres. 07052021 individual supply commercial property gst malaysia.

Ii Taxable person means any person who is or is liable to be registered under section 2 GSTA. Sales of commercial real estate such as office towers retail buildings and land zoned for commercial use are subject to a 6 percent GST if the seller is an individual is engaged in the business.

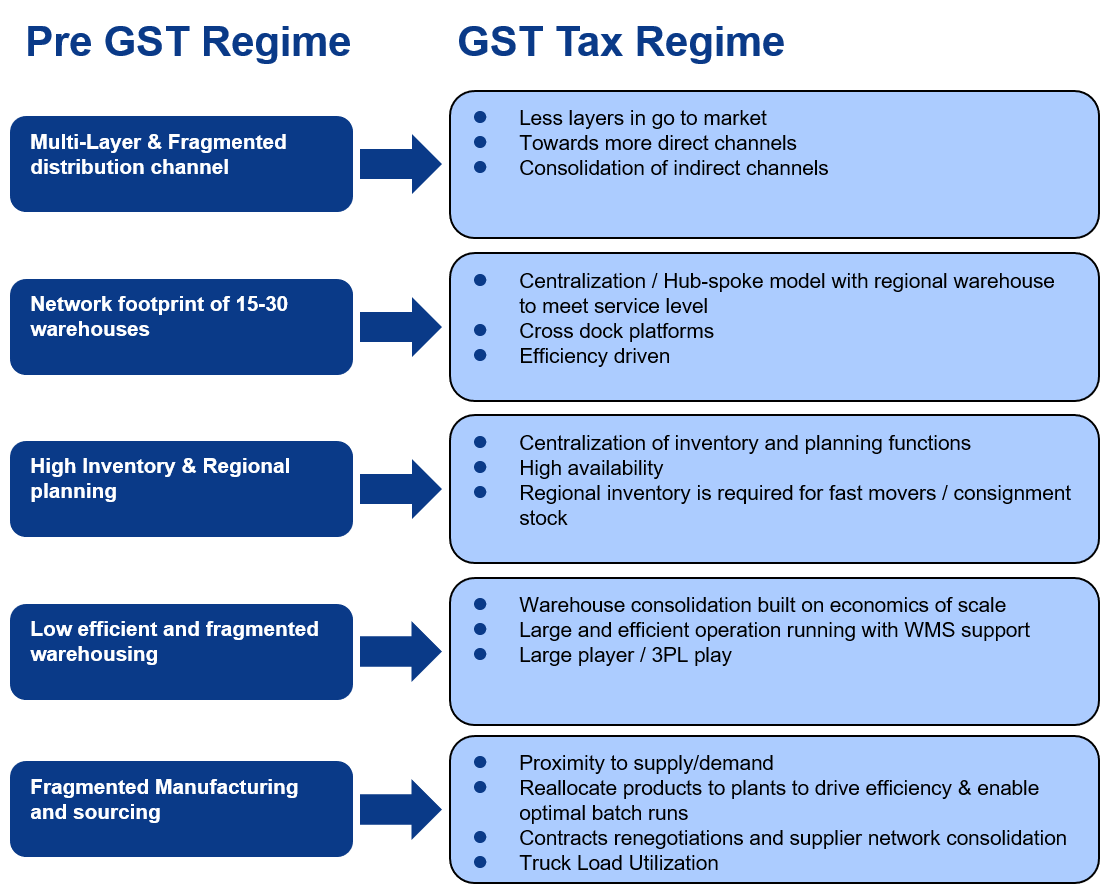

Future Supply Chain Fsc India Twitter

The Connection Issue 21 Individual Supply Of Commercial Property Land Cheng Co Group

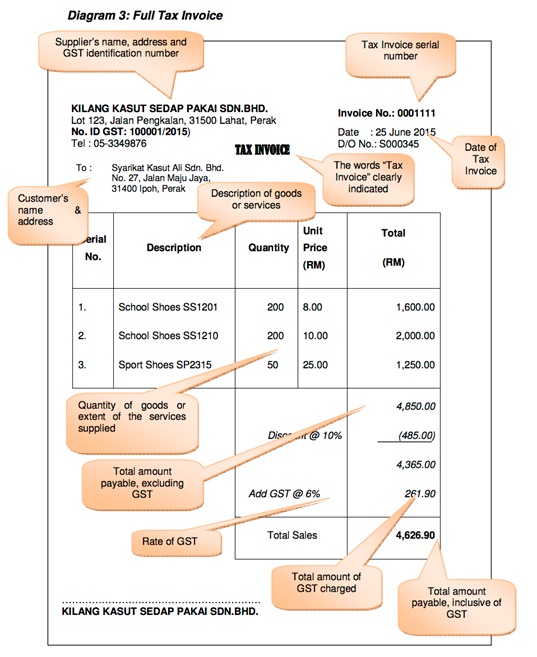

Gst And Commercial Property Guide B2bpay

India S Tax Reform Its Impact To Supply Chain

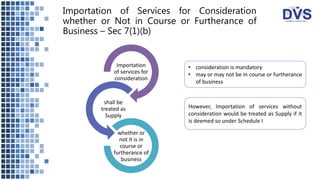

Removed Exemption On Supply Of Pure Services And Composite Supply Of Goods Services Where Value Of Supply Of Goods Is Not More Than 25 To A Governmental Authority Entity A2z

Sap Logistics Business Network Material Traceability Participant Option Consumers Sap Store

Roambee Blog Supply Chain Technology

The Connection Issue 21 Individual Supply Of Commercial Property Land Cheng Co Group

What Is Supply Under Gst Accoxi

Real Estate New Gst Rates And Challenges

Roambee Blog Supply Chain Technology

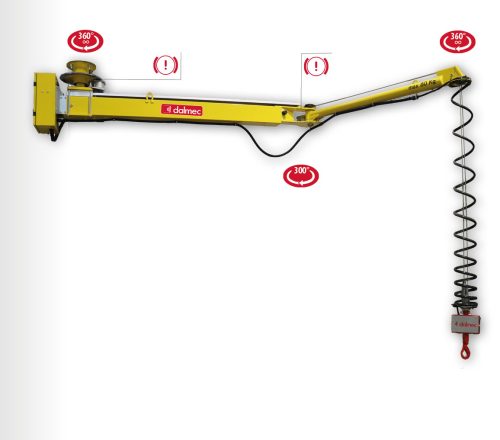

Dalmec Industrial Manipulators And Material Handling

Sap Logistics Business Network Material Traceability Participant Option Consumers Sap Store

Future Supply Chain Fsc India Twitter

Sap Logistics Business Network Material Traceability Participant Option Consumers Sap Store

Everything You Need To Know About Gst On Commercial Vehicles